Sustainability

サステナビリティ

- HOME

- Sustainability

- Responding to Climate Change Issues

- HOME

- Sustainability

- Responding to Climate Change Issues

Responding to Climate Change Issues

Our basic view on climate change issues

In recent years, climate change has become a source of significant socioeconomic risk and opportunity, and the movement toward decarbonization is spreading around the world.

The Purchase and Resale Business, the Group's core business, is an environmentally friendly business model that promotes the revitalization and distribution of existing real estate and makes effective use of existing resources.

At the same time, we recognize that we may be affected by various impacts of climate change, such as flooding, and that addressing climate change is essential to the sustainability of our business.

As part of our commitment to environmentally friendly business activities to realize a sustainable society, the Group have agreed to the TCFD (Task Force on Climate-related Financial Disclosure) recommendations and will identify risks and opportunities for our business activities arising from climate change and disclose appropriate information.

Strategy

Scenario Analysis

The TCFD recommendations include a recommendation for conducting a scenario analysis. It is an assessment of climate-derived impacts on businesses on the basis of multiple climate scenarios. For developing and studying strategies to deal with future uncertainties, we conducted a scenario analysis mentioned below.

For this scenario analysis for the first year, we conducted qualitative and quantitative studies to estimate the situation in 2050 according to two scenarios. One is the 4°C scenario, in which extreme weather will be intensified after no climate actions that surpass the current ones are taken. The other is the 1.5°C scenario, in which ambitious climate actions are implemented with a view towards decarbonization.

■ 4°C scenario

(Risks arising from transition to a carbon-free society: Small,Physical risks of extreme weather and others: Large)

This scenario envisions an average temperature rise in the range from 3.2°C° to 5.4°C (approximately 4°C) in 2100 from the industrial revolution.

No positive policies and statutory regulations for mitigating the impacts of climate change will be implemented. The intensification of extreme weather will be severe.

[Referenced scenarios] IEA Stated Policies Scenario and RCP 8.5 Scenario

■1.5°C scenario

(Risks arising from transition to a carbon-free society: Large, Physical risks of extreme weather and others: Small)

This scenario envisions an average temperature rise of less than 1.5°C in 2100 from the industrial revolution.

Tougher policies and statutory regulations than the existing ones will be implemented to control climate change and to achieve carbon neutrality.

[Referenced scenarios] IEA Net Zero Emissions by 2050, Sustainable Development Scenario and RCP 2.6 Scenario

The studies estimate that climate change has a principal risk of causing floods and high tides that will bring about physical damage to properties owned in both scenarios. In the future, we will take enhanced disaster control measures, including toughening the criteria for the selection of real estate locations in consideration of hazard maps, in order to increase business resilience.

On the other hand, there are opportunities anticipated in the 1.5°C scenario. They include an increase in demand for renovation into zero emission buildings (ZEBs) and houses (ZEHs) for energy conservation and the use of renewable energy amid the transition to a carbon-free society and an increase in opportunities for business revenue linked to the rising environmental value of used real estate. We will continue business activities with environmental considerations to help build a carbon-free society and control climate change.

List of climate-related risks and opportunities estimated in the Group

Metrics and targets

Our Group will promote business activities while considering the environment by reducing GHG emissions from our business activities (Scope 1 and 2) and GHG emissions from other companies related to our business activities (Scope 3) .

As medium-term reduction targets for Scope 1 and Scope 2, we have set a target of reducing emissions by 46% per unit of sales (compared with FY2021) by FY2030, and as a long-term target, we aim to achieve carbon neutrality by FY2050, with reference to the targets of the Paris Agreement.

While we expect GHG emissions to increase in line with business growth and entry into new businesses, we will continue to strengthen our efforts to reduce emissions. We will contribute to the creation of a sustainable society by promoting multifaceted measures to improve energy efficiency, promoting low-carbon energy use while maximizing environmental value, and examining further reduction methods.

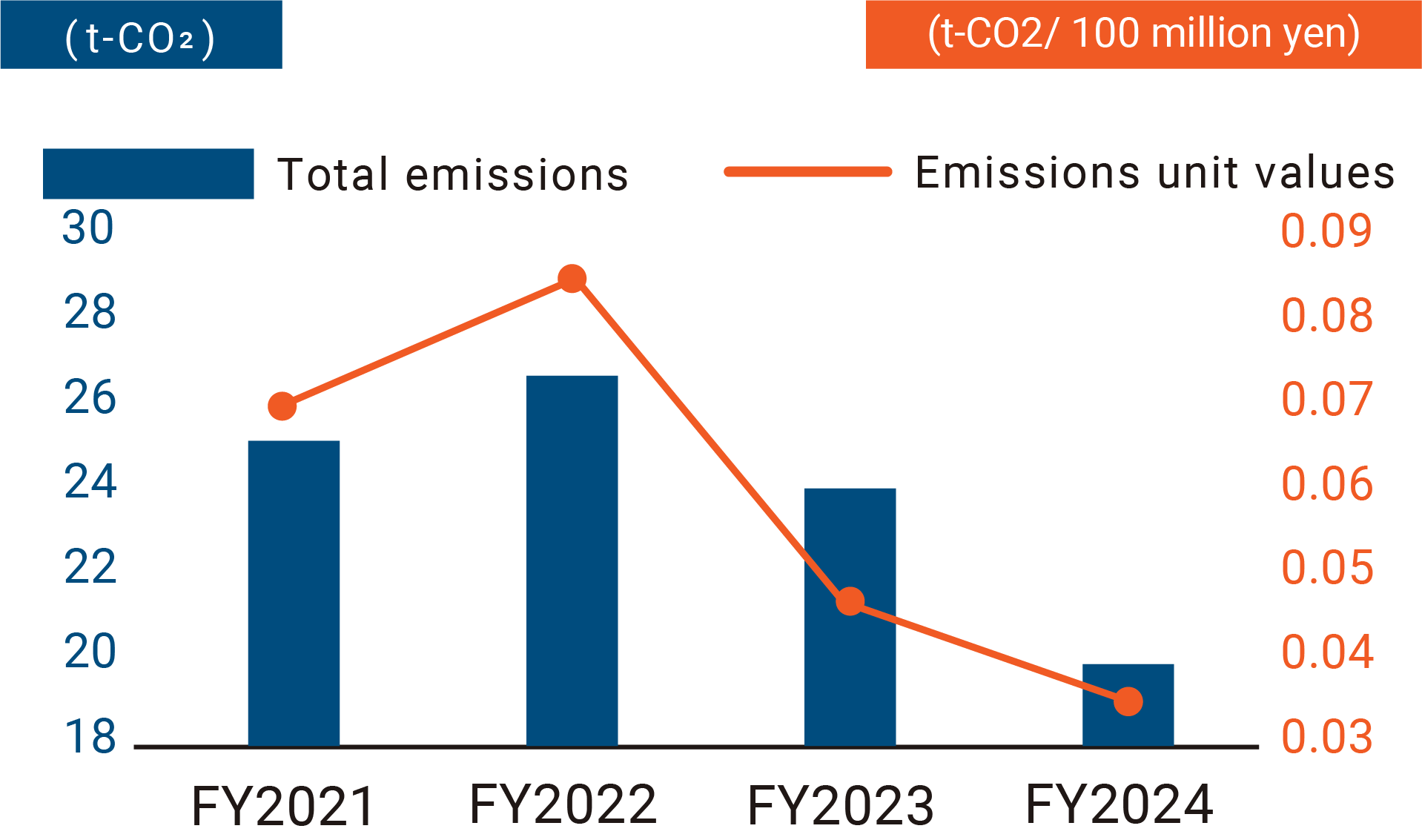

【Scope1】

In FY2024, Scope 1 emissions were 20.9 t-CO2, which was lower than the previous year's emissions, and the emission intensity was 55.9% lower than in FY2021. In order to reduce environmental impact and operating costs, we reviewed the vehicles we owned and replaced or sold them for vehicles with higher fuel efficiency, which led to a reduction in emissions.

| Total emissions (t-CO2) |

Emissions unit values | ||

|---|---|---|---|

| (t-CO2/100 million) | FY2021 | ||

| FY2021 | 25.9 | 0.076 | |

| FY2022 | 27.1 | 0.087 | +13.8% |

| FY2023 | 24.7 | 0.048 | ▲37.3% |

| FY2024 | 20.9 | 0.034 | ▲55.9% |

Scope:The Mugen Estate Group

- ※Scope1:

- Greenhouse gas emissions from fuel consumption

As for the Company, emissions resulting mainly from the use of company cars(gasoline cars) fall under this scope.

- ※Emissions unit values

- :Emissions per unit of net sales

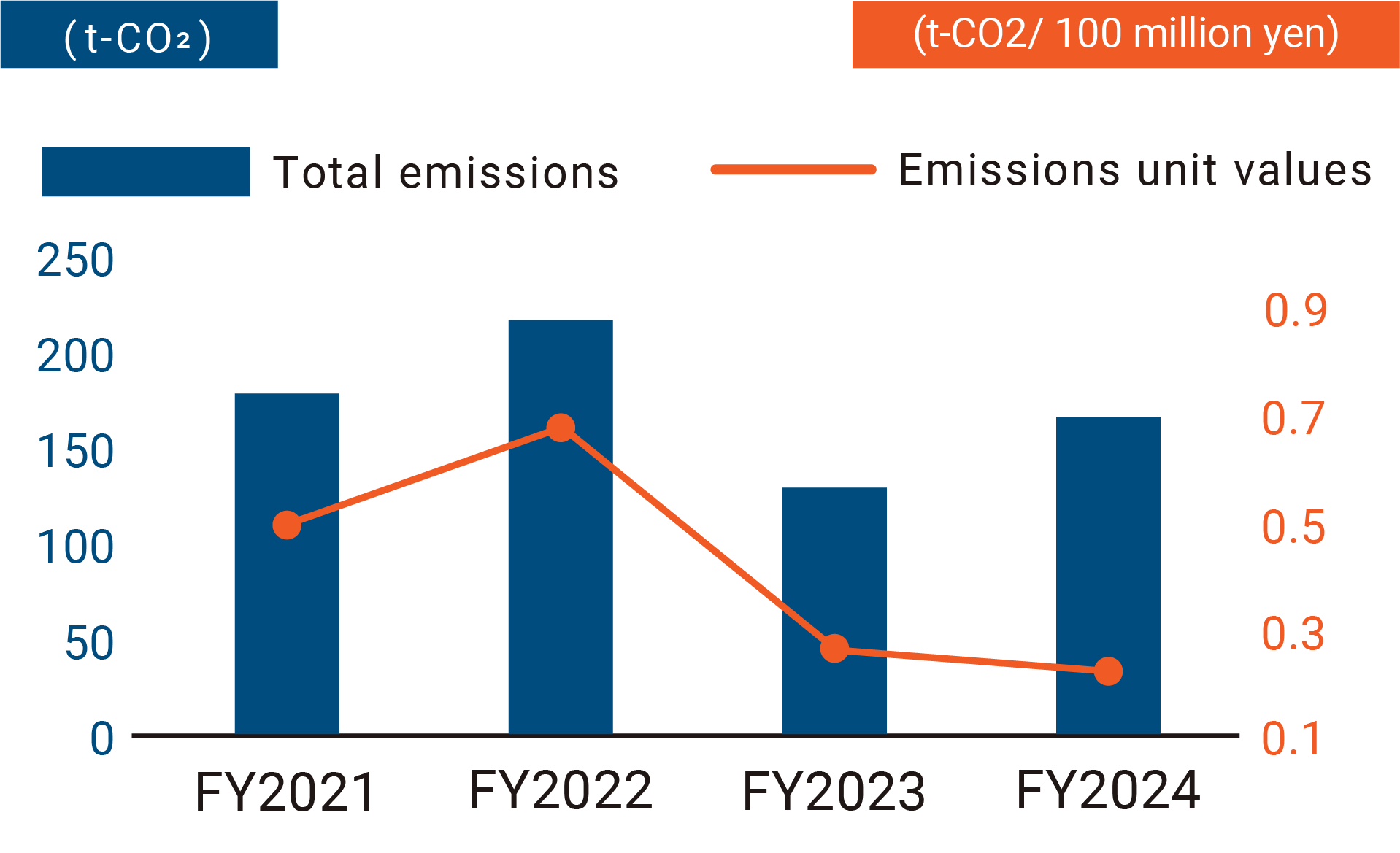

【Scope2】

In FY2024, Scope 2 emissions were 153.1 t-CO2, which was slightly higher than the previous year, but the emission intensity was 49.9% lower than in FY2021. The main factor for the increase was an increase in electricity consumption due to the establishment of new sales offices. On the other hand, as a result of reclassifying some of our fixed assets to real estate for sale, emissions related to fixed assets decreased.

| Total emissions(t-CO2) | Emissions unit values | ||

|---|---|---|---|

| (t-CO2/100 million) | FY2021 | ||

| FY2021 | 166.8 | 0.491 | |

| FY2022 | 215.5 | 0.690 | +40.5% |

| FY2023 | 145.9 | 0.282 | ▲42.5% |

| FY2024 | 153.1 | 0.246 | ▲49.9% |

Scope:The Mugen Estate Group

- ※Scope2:

- Greenhouse gas emission from electric power consumption

As for the Company, emissions from fixed assets account for at least 90% of its Scope 2 emissions.

- ※Emissions unit values:

- Emissions per unit of net sales

【Scope3】

In FY2024, Scope 3 emissions were 66,505.9 t-CO2, which is a 4.5% decrease compared with the previous year. The main factor was a decrease in emissions in categories 2, 11, and 13. In particular, for Category 11, which accounts for 60% of Scope 3, the percentage of properties with a short remaining statutory useful life increased as a result of promoting the sale of long-term holding properties, resulting in a decrease in emissions. We recognize that it is essential to continue to expand sales while at the same time taking steps to curb increases in emissions, such as by trading in real estate with high environmental performance ratings and developing real estate, with the aim of further reducing emissions in the future.

| FY2022 Emissions(t-CO2) |

FY2023 | FY2024 | |||||

|---|---|---|---|---|---|---|---|

| Emissions(t-CO2) | Year on Year | Emissions(t-CO2) | Year on Year | ||||

| Category1 | Purchased goods and services | 13,134.1 | 17,784.2 | +35.4% | 20,286.3 | +14.1% | |

| Category2 | Capital goods | 117.7 | 1,194.5 | +914.8% | 501.0 | ▲58.1% | |

| Category3 | Fuel- and energy-related activities | 43.6 | 37.7 | ▲13.5% | 35.9 | ▲4.8% | |

| Category4 | Upstream transportation and distribution | 26.9 | 25.9 | ▲3.6% | 22.7 | ▲12.5% | |

| Category5 | Waste generated in operations | 1,066.5 | 940.1 | ▲11.8% | 777.0 | ▲17.4% | |

| Category6 | Business travel | 32.9 | 38.5 | +17.1% | 51.0 | +32.5% | |

| Category7 | Employee commuting | 98.9 | 115.9 | +17.2% | 151.9 | +31.0% | |

| Category8 | Upstream leased assets | - | - | - | - | - | |

| Category9 | Downstream transportation and distribution | - | - | - | - | - | |

| Category10 | Processing of sold products | - | - | - | - | - | |

| Category11 | Use of sold products | 26,805.6 | 44,450.6 | +65.8% | 40,224.0 | ▲9.5% | |

| Category12 | End-of-life treatment of sold products | 1,234.8 | 1,842.6 | +49.2% | 1,861.3 | +1.0% | |

| Category13 | Downstream leased assets | 3,354.8 | 3,229.6 | ▲3.7% | 2,595.0 | ▲19.7% | |

| Category14 | Franchises | - | - | - | - | - | |

| Category15 | Investments | - | - | - | - | - | |

| Total | 45,915.7 | 69,659.6 | +51.7% | 66,505.9 | ▲4.5% | ||

Scope:The Mugen Estate Group

- ※Scope 3:

- Indirect greenhouse gas emissions which are outside Scopes 1 and 2

(emissions from other companies associated with the activities of the reporting company)

- ※Category 3 emissions do not include Scope 1 and 2 emissions.

- ※Categories 8, 9, 10, 14 and 15 emissions are not included because they are outside the scope of the Group’s business activities.

Information disclosure based on the TCFD recommendations

The Mugen Estate Group has recently agreed to the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations as part of its efforts to realize a sustainable society with environmental considerations. In addition, we will understand the risks and opportunities of businesses, etc. arising from climate change and make appropriate information disclosures.