Business Risks

Basic Policies

In formulating and executing business strategies, MUGEN ESTATE Group (the "Group") identifies factors that may cause physical, economic, or credibility loss or disadvantage as risks, classifies them by the degree of impact on business management and the frequency of occurrence, and determines important risks for the Group based on the results of assessment. When important risks become apparent, we regard risks that have a significant impact on our business as risks that require monitoring, focus on monitoring the progress of risk countermeasures, and work to strengthen risk countermeasures across the Group.

In implementing our business strategies, we have established a risk management system that provides appropriate responses to prevent potential risks from occurring, and a crisis management system that minimizes losses in the event of serious risks arising.

When a state of emergency was declared in response to the COVID-19 pandemic, the Group established emergency response headquarters based on its Emergency Response rules, assessed business impact and implemented necessary measures from two perspectives: preventing the spread of infection and business continuity.

Risk Management System

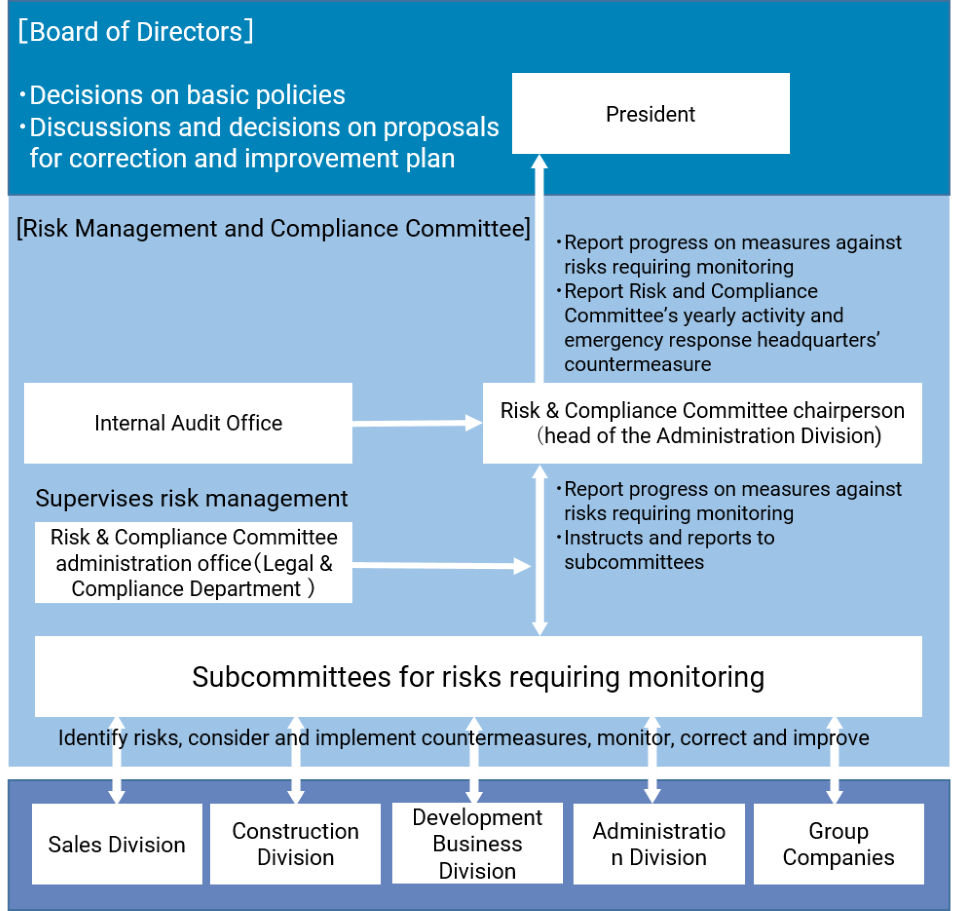

In implementing risk management for the Group, the Risk Management and Compliance Committee—chaired by the head of the Administration Division, also a director—is held four to five times during this fiscal year to identify risks that have become apparent within the Group, discuss measures to prevent recurrences and measures for risks reduction, evaluate and monitor their effectiveness, and report the results to the Board of Directors.

The Risk Management and Compliance Committee—attended by the managers of each division and Group company—classifies risks into external environment, internal environment and business process risks, conducts risk assessments from the perspective of impact and probability of occurrence of risk items identified from each category, and identifies risk items anticipated to have a significant impact on corporate activities as risks that require monitoring. A person in charge is appointed from the relevant departments for each risk identified as requiring monitoring, and risk response measures are discussed and implemented by subcommittees under the main committee. Progress is checked quarterly through monitoring. Corrections and improvements are made as necessary, and reported to the Board of Directors.

Risks that derive from climate change are identified from individual departments by the Sustainability Committee. They are then examined both qualitatively and quantitatively and the findings are reported to the Risk Management and Compliance Committee. Thus, they are incorporated into the risk management of the entire Group.

Risk Management System Diagram

Matters Recognized as Main Risks

Main risks relating to business conditions and financial status, etc., as stated in the annual securities report, which may affect investors' decisions are as follows.

The forward-looking statements below are based on judgments of the Group as of the end of the consolidated fiscal year under review. Risks that may arise are not limited to the risks below.

(1) Risks associated with changes in economic trends and society systems

The business of the Group is influenced by a variety of factors, including real estate-related social infrastructure; taxes, regulations and other legal systems; securities market and other economic trends; and laws and regulations of other countries in relation to overseas investors with whom we recently have an increasing number of real estate sales transactions. Changes in the above factors may affect the business performance and the financial condition of the Group.

In its second medium-term management plan, the Group has established four management policies: strengthening its earnings base for business expansion, building a network for securing revenue opportunities, increasing organizational strength to support business growth, and promoting digital transformation to support business expansion and growth. We have become particularly sensitive to a variety of risks associated with the Purchase & Resale Business because our growth has been propelled centering on that business. In response, we are making efforts to minimize our sensitivity to these risks by offering a wide range of real estate-related products and services and maintaining a portfolio that does not rely on specific business.

(2) Risks associated with purchases/sales

The Real Estate Trading Business, the core business of the Group, focuses on the Tokyo Metropolitan Area (Tokyo, Kanagawa, Chiba, and Saitama Prefectures). Because barriers to entry are low with respect to the purchase and resale of residential-type properties, competition with other companies is intensifying. The competitive environment surrounding investment-type properties is also becoming increasingly severe year after year, partly because of new entry into the market of a leading real estate company. In case the Group is unable to generate targeted profit rate levels due to business conditions, making it difficult to conduct purchase/sales as planned, it may affect the business performance and financial condition of the Group.

The Group is moving a step ahead of its competitors by responding to the needs of real estate brokerage firms and asset owners through reinforcing area businesses by establishing offices in each area from 2021, while handling a broad range of asset types and price categories and the execution of contracts/settlement procedures with promptly. We strive to conduct the purchase and sale of properties on a broad basis, even amid harsh conditions in which it difficult to implement purchases, by means such as refurbishing properties according to the characteristics of their locations and areas based on our experience and database cultivated over many years.

(3) Risks associated with reliance on interest-bearing debt and interest-rate fluctuations

The Group procures funds for purchasing used real estate in its Real Estate Trading Business primarily through borrowings from financial institutions. As a result, the ratio of interest-bearing debt to total assets at the end of the consolidated fiscal year under review was 63.7%. If interest rates rise or if the lending stance of financial institutions changes due to changes in the monetary condition, it may affect the performance and financial condition of the Group because of increases in interest paid, changes in purchase plans and so forth.

The Group has set a target of no more than 65% for the ratio of interest-bearing debt to total assets as an indicator of financial soundness and strengthens its financial condition by constantly managing equity ratio, debt-to-equity ratio and other indicators. Moreover, the Group has established excellent relationships with financial institutions for smooth transactions by not relying on specific financial institutions and by procure funds through borrowings after analyzing the appropriateness of the sales plan in each individual project.

(4) Risks associated with valuation loss on real estate for sale

The Group applies the Accounting Standards for Measurement of Inventories (ASBJ Statement No. 9 announced on July 4, 2019) to the real estate for sale that the Group owns. For investment-type properties among the real estate for sale held at the end of the fiscal year, we compare the book value after depreciation with net selling price, and if the net selling price is lower than the book value, we record a valuation loss on goods. For residential-type properties among the real estate for sale, such as owned condominium units and detached houses, we compare the purchase price with net selling price, and if the net selling price is lower than the purchase price, we record a valuation loss on goods. If future sales fall short of initial targets due to a decline in the economic or real estate market conditions, real estate for sale may be retained as inventory. The prolonged retention of this real estate may result in a net selling price that is lower than the book value or purchase price, causing a valuation loss on goods, which may affect the performance and financial condition of the Group.

The Group closely monitors trends in the real estate trading market and strives to grasp any impact on its performance, manage work in progress and increase precision. Although the cycle times from the purchase to the sale are short in the Purchase & Resale Business, some inventory is retained for a long time. Accordingly, purchase prices are strictly reviewed when purchasing, and determined to secure certain levels of profits even amid market fluctuations when this inventory is held. Moreover, if some properties are held as inventory, the Group works to improve and enhance investment returns through appropriate renovation plans and rent rates in order to significantly minimize the lowering of net selling prices.

(5) Risk of bankruptcy of contractors in developments

When the Group builds a single building for sale, it entrusts the construction work to an external construction company. We actively develop links with new contractors, such as through referral of construction contractors through employees, business partners, and other related parties, and work to maintain and build stronger and better relationships with existing construction contractors. If we fail to sufficiently secure a contractor that meets the Group's selection criteria, or if the construction period is delayed and outsourcing prices rise due to difficulties in the management or labor shortages of construction contractors, the Group's business performance and financial standing may be affected.

(6) Risks associated with legal regulations

The real estate industry, in which the Group operates, is regulated by laws such as the Building Lots and Buildings Transaction Business Act, the Building Standards Act, the City Planning Act, the National Land Use Planning Act, the Act on Land and Building Leases, the Act against Unjustifiable Premiums and Misleading Representations and the Fair Competition Code Concerning Indication of Real Estate. The revision or abolition of these legal regulations or the enforcement of new laws and regulations in the future may affect the performance and financial condition of the Group.

The Group ensures its compliance with legal regulations. If, however, a legal violation occurs for some reason in the future and the Group’s operation is suspended or its licenses are revoked by the regulatory authorities, its business activities will be interrupted and the performance and financial condition of the Group may be affected.

The General Affairs Department of the Company plays a central role in responding to a range of legal regulations, including the implementation of compliance training and seminars for employees to increase their compliance awareness. Mainly from the perspectives of risk management and crisis management, the Risk Management and Compliance Committee examines measures against major risks faced by the entire group, and establishes measures for the prevention of compliance violations. We strive to obtain the latest information on any revision of relevant legal regulations in collaboration with external organs and lawyers, and ensure that all employees in the Group are thoroughly aware of this information.

The following table lists the effective periods and other expiration dates of legal regulations specified by laws, regulations and contracts.

(Mugen Estate Co., Ltd.)

| Name of license, etc. | License(registration) number |

Valid term | Relevant laws | Reason for revocation or refusal to renew license, etc. |

|---|---|---|---|---|

| Real Estate Brokerage License | Minister of Land, Infrastructure, Transport and Tourism (3) No. 7987 |

May 14, 2020 – May 13, 2025 | Real Estate Brokerage Act | Article 5 and Article 66 |

| First-class Architect Office Registration | Registered with the Governor of Tokyo No. 51257 |

July 20, 2020 – July 19, 2025 | Act on Architects and Building Engineers | Article 26 |

| Specified Joint Real Estate Business permit | Registered with the Governor of Tokyo No. 105 |

― | Act on Specified Joint Real Estate Business | Article 36 |

(FUJI HOME Co., Ltd.)

| Name of license, etc. | License (registration) number |

Valid term | Relevant laws | Reason for revocation or refusal to renew license, etc. |

|---|---|---|---|---|

| Real Estate Brokerage License | Registered with the Governor of Tokyo (6) No. 75654 |

October 4, 2022 – October 3, 2027 | Real Estate Brokerage Act | Article 5 and Article 66 |

| First-class Architect Office Registration | Registered with the Governor of Tokyo No. 56843 |

February 5, 2021 – February 4, 2026 | Act on Architects and Building Engineers | Article 26 |

| Construction License | Minister of Land, Infrastructure, Transport and Tourism (Special–4) No. 28616 |

August 25, 2022 – August 24, 2027 | Construction Business Act | Article 29 and 29-2 |

(7) Risks associated with liability for contractual noncompliance and lawsuits, etc.

The Group is legally responsible for contractual nonconformities for two years after delivery of used and refurbished houses it sells, in accordance with the provisions of the Civil Code and the Real Estate Brokerage Act. In addition, for newly constructed houses that the Group sells, the Group bears the liability for defect warranty for ten years after delivery, mainly with respect to defects in the main aspects of the structural resistance of the houses, pursuant to the provisions of the Civil Code and the Housing Quality Assurance Act. To thoroughly ensure quality control, the Group checks the quality of properties using its own original checklist before the renovation work starts and when work is completed. However, if there is a contractual nonconformity in a sold property, it may be necessary to bear unscheduled costs for the repair of the nonconforming part, compensation for damages, or termination of contract, etc. Additionally, regarding the properties sold, although the Group has not been subject to the filing of significant lawsuits that directly affect business results, if legality or appropriateness is lacking in business procedures, then there is a possibility that complaints, etc., may be received, and lawsuits may arise in connection with them.

In order to prevent such lawsuits, disputes, or claims, the Group has established manuals, etc., regarding handling of complaints, and is working to establish internal systems. However, if such a situation occurs in the future, the Company's business performance and financial standing may be affected (depending on the details and outcome of such situations).

(8) Risks related to information security

The Group handles large amounts of confidential information, including personal information, in each of its businesses. In handling this confidential information, we strive to comply with relevant laws and regulations, including the Act on the Protection of Personal Information, and ensure appropriate handling. In the event that confidential information is leaked due to unforeseen circumstances, such as the occurrence of an information security incident, the Company's business performance and financial standing may be affected by a decrease in social credibility, etc. In addition, information system trouble or other damage caused by a cyberattack or similar incident may seriously affect the Group's business continuity.

(9) Risks associated with natural/man-made disasters

The used real estate handled by the Group is located primarily in the Tokyo Metropolitan Area (Tokyo, Kanagawa, Chiba, and Saitama Prefectures). If a natural disaster, such as an earthquake, a fire and flood, or a man-made disaster, such as a large accident or terrorist attack, strikes the Tokyo Metropolitan area, the used real estate owned by the Group may be lost, damaged or degraded, and its resale value or rental revenue may be significantly decreased.

Even if a natural or man-made disaster strikes a region other than the Tokyo Metropolitan area, a decline in consumer confidence may affect the performance and financial condition of the Group.

As part of the earthquake countermeasures, the Group refrains from owning properties constructed while the old Building Standards Act was in force, and examines the seismic capacity of properties owned, aiming to minimize the impact if risks are realized.

(10) Risks associated with securing human resources

The Group recognizes that to continually secure and foster talented human resources is the top management task to overcome a variety of business challenges. Accordingly, we pursue a strategy of cultivating responsible employees with a good understanding of the Group’s management philosophy by recruiting talented mid-career professionals and new graduates and by working to enhance its education and training programs. However, if progress in securing and fostering human resources that the Group requires is not made in accordance to the plans, it may affect its performance and financial condition.

Under its personnel system, the Group has defined human resources needed for the expansion of the Group and built a system to support the growth of each employee (a personnel framework by the kind of work and an appraisal system that encourages growth and rewarding wage system) by renewing its personnel assessment system, as an initiative aimed at achieving further growth. However, if the functioning of the Group's personnel system is hindered by poor evaluator skills and communication with subordinates, it may lead to a decrease in employees’ motivation or outflow of human resources.

(11) Risks associated with impacts from the COVID-19 pandemic

As prospects for the containment of the COVID-19 pandemic remain uncertain, if socio-economic activities stagnate in the future and restrictions are imposed on movements of real estate brokerage firms, financial institutions, end-users and overseas investors who are clients of the Company, it may cause declines in real estate investment and demand for the rental market, decreases in housing acquisition needs partly associated with restrictions on tours of properties, delays and suspension in supplies of materials for the architectural interior and exterior furnishing industry, declines in demand from overseas investors due to severe restrictions on entry into Japan, among other things. This may lead to significant declines in distribution volumes in the real estate trading market and may affect the performance and financial condition of the Group.

In April 2020, when a state of emergency was declared, the Group established emergency headquarters in accordance with its Emergency Response rules and started to examine impacts on our business and to implement infection countermeasures for employees. Countermeasures include the implementation of non-face-to-face operating activities, the upgrading and expansion of information on properties on our webpages for real estate brokerage firms through the use of virtual reality and other internet applications, and the securing of suppliers of materials. In addition, we devised measures for our employees, such as the transition of working systems through the introduction of a remote work system, and the suspension of group training and events as well as the upgrading and expansion of initiatives for business continuity in stages. The Group will maintain infection countermeasures in the future and will strive to offer properties and services in a timely manner in response to changes in real estate values that reflect new lifestyles and changes in workstyles.